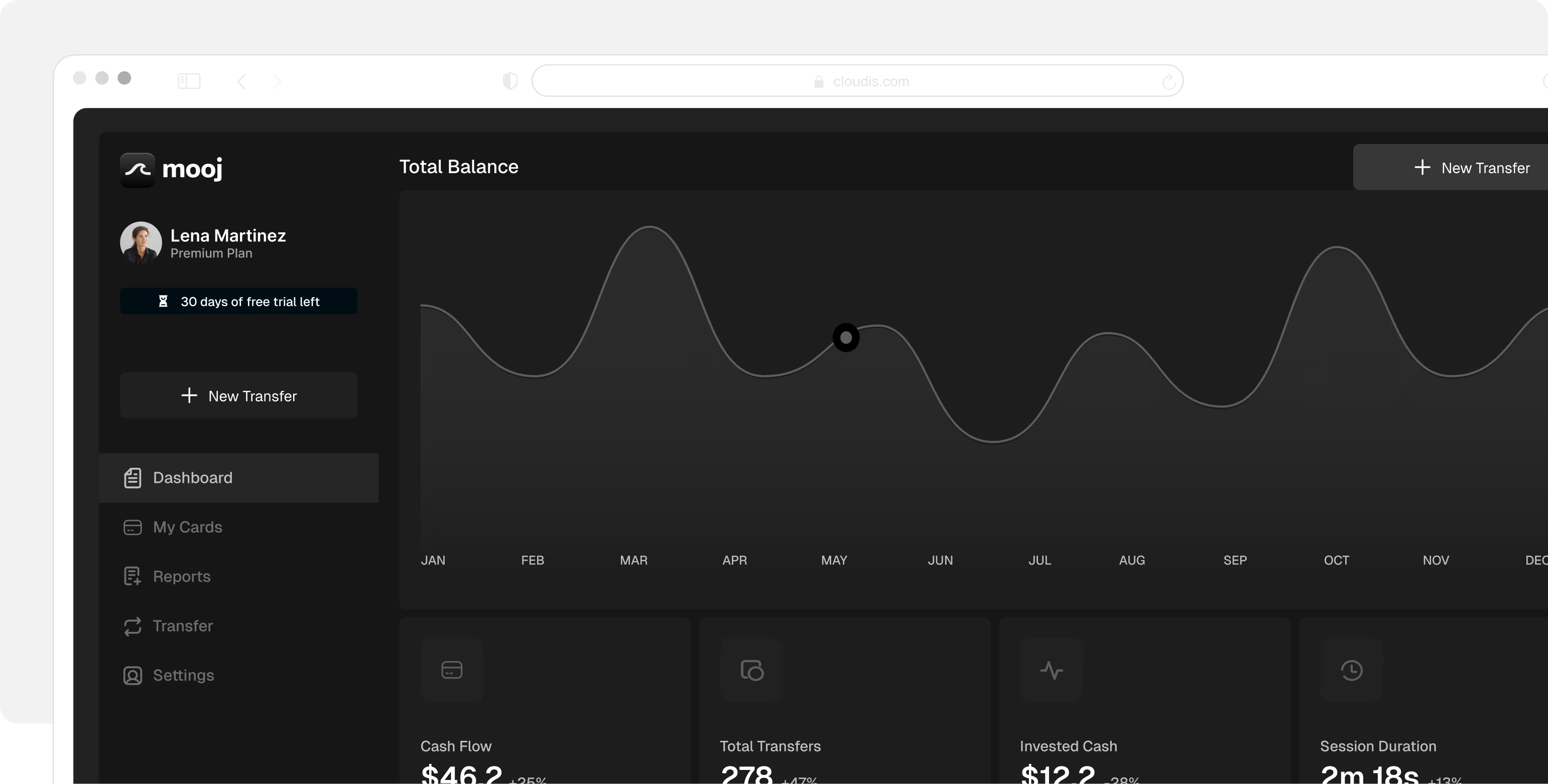

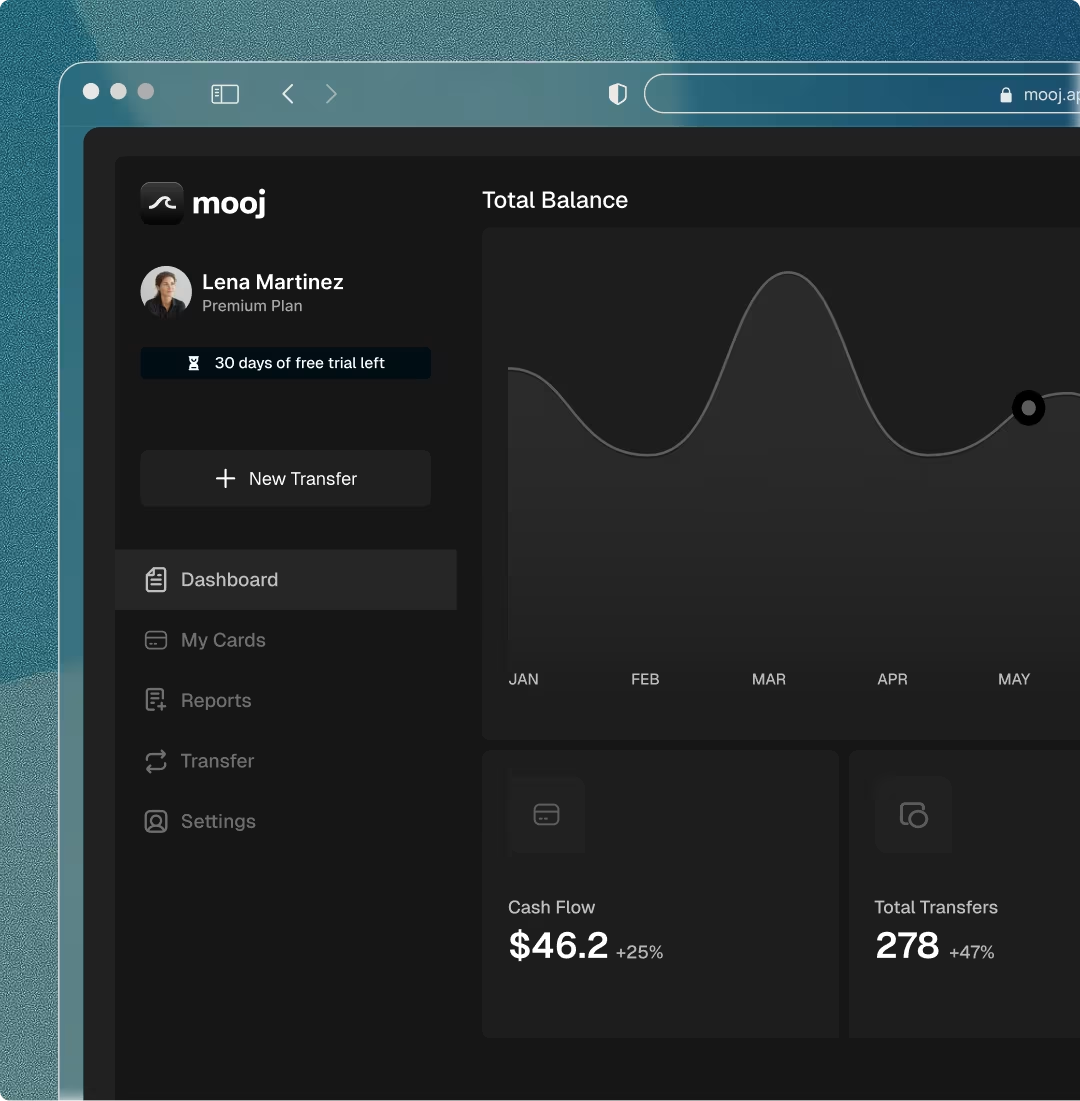

The Self-Driving Business Account

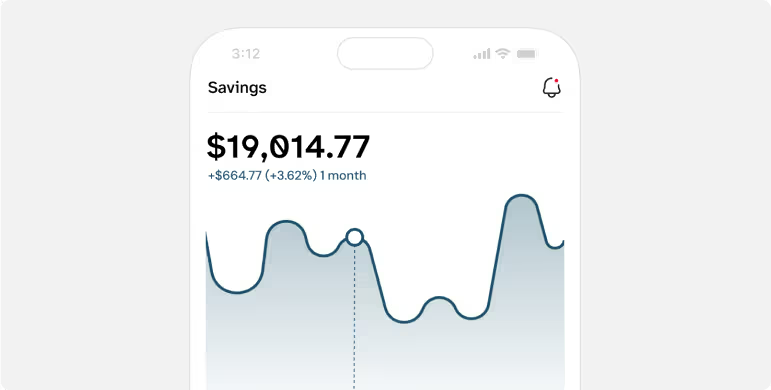

Smart Tools to Power Your Finances

Go Borderless.

Finance, Your Way

Why Our Users Love Mooj

Simple Pricing for Every Stage of Growth

- 1 Business IBAN (AED)

- 1 Virtual Card

- 1 Custom AI Agent Policy

- 1 Connected AI Agent

- 1 Business IBAN (AED)

- 1 Virtual Card

- 1 Custom AI Agent Policy

- 1 Connected AI Agent

- 3 Business IBANs (AED | USD | EUR or GBP)

- Unlimited Virtual Cards

- Up to 20 AI Agent Policies

- Connected AI Agents (Up to 20)

- 3 Business IBANs (AED | USD | EUR or GBP)

- Unlimited Virtual Cards

- Up to 20 AI Agent Policies

- Connected AI Agents (Up to 20)

- Everything in Premium

- Unlimited users and account permissions

- Custom API integrations and SLAs

- Unlimited AI Agents & Custom Policies

- Everything in Premium

- Unlimited users and account permissions

- Custom API integrations and SLAs

- Unlimited AI Agents & Custom Policies

Insights & Updates from mooj

All You Need to Know

Mooj is a modern digital finance platform that helps individuals and businesses manage money, send payments, and automate everyday financial tasks, all from a single dashboard.

No, Mooj is a financial technology company. We partner with regulated banks and licensed payment providers to ensure your funds are secure and compliant.

Absolutely. You can register your business and invite team members to collaborate with customizable permissions and shared access.

No credit check is required to open a personal or business account. You’ll just need to verify your identity and provide basic information.

We currently support users in over 40 countries globally, and we’re working to expand even further.

Yes. You can instantly generate virtual cards, and request physical cards shipped to your address, with full control via your dashboard.

Most payments are processed instantly or within minutes, depending on the destination and method. International transfers may take 1–2 business days.

.png)